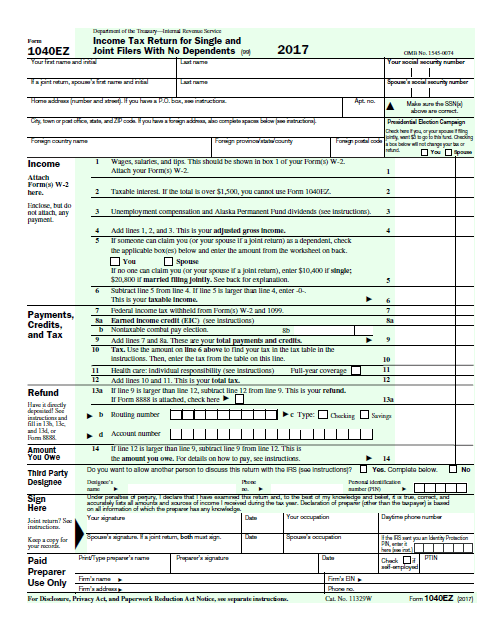

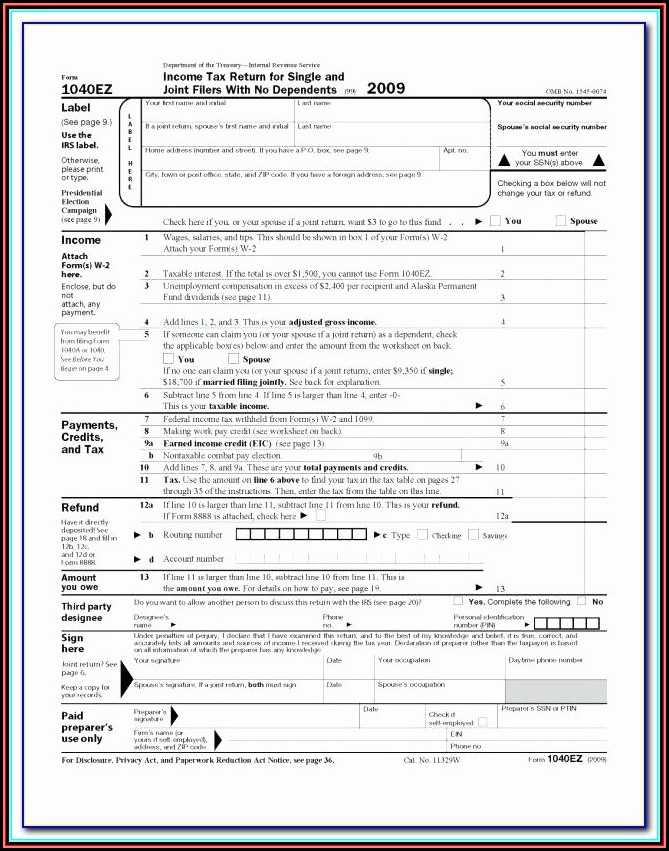

In 2018, short 1040 forms like the 1040A and 1040EZ were eliminated with tax reform, so you can’t use them to file any longer (for your amended or an original 2018 return). If you’re filing your 2019 Form 1040, you should use the Form 10. This post covers the Form 10, so if you’re amending or filing an original tax return for a different year, you can look to the information specific to that year. That’s because in 2018 was the first year Form 1040 changes appeared due to the Tax Cuts and Jobs Act. Don?t wait to test it and have more time on hobbies rather than on preparing documents.You’ll see the 2018 Form 1040 looks very different from prior years’ forms.

Using our complete digital solution and its beneficial tools, filling in IRS 1040 becomes more convenient. It is possible to download the record to print it later or upload it to cloud storage. You have the possibility to use online fax, USPS or electronic mail. Correct mistakes if needed.Ĭlick on Done to finalize modifying and select the way you will deliver it. Make your unique e-signature once and put it in the needed places.Ĭheck the information you have included. You will get useful tips for simpler submitting. If you have any difficulties, turn on the Wizard Tool.

Repeating information will be filled automatically after the first input. Open the document in our professional PDF editor.įill in all the details needed in IRS 1040, using fillable lines.Īdd pictures, crosses, check and text boxes, if needed. You only need to follow these easy guidelines: Making use of our ultimate platform you will understand how to fill IRS 1040 in situations of critical time deficit. IRS 1040 is not the easiest one, but you do not have reason for worry in any case.

If the tax season started unexpectedly or maybe you just forgot about it, it could probably cause problems for you.

0 kommentar(er)

0 kommentar(er)